Gallery

Candy.ai Review: Market-Leading AI Companion Platform with Privacy Concerns and Regulatory Challenges

Candy.ai dominates the AI companion market with $25M+ annual recurring revenue, offering highly customizable virtual girlfriends with sophisticated memory systems, voice calls, and image generation. Premium subscriptions cost $12.99-$47.88 annually with token-based supplementary charges. Trustpilot rating: 4.3/5 (1,200+ reviews). However, privacy policies remain vague regarding data encryption, third-party access, and retention periods. The platform lacks transparent age verification mechanisms, raising CSAM concerns amid rapidly escalating legal criminalization of AI-generated child sexual abuse material.

Accepted

Candy.ai has established itself as the dominant force in the AI companion market by achieving $25+ million in annual recurring revenue within approximately two years of launch. The platform stands out through exceptionally sophisticated conversational AI, deep character customization capabilities, voice integration, multimedia generation, and a large library of pre-built characters alongside custom creation functionality. Candy.ai has cultivated 4.3/5 user ratings on Trustpilot (1,200+ reviews) and commands a disproportionately large user base relative to competitors. However, this market leadership coexists with serious concerns regarding privacy transparency, data security practices, age verification adequacy, and escalating legal exposure in an increasingly regulated landscape around AI-generated sexual content.

Market Position and Rapid Growth

Candy.ai's explosive growth trajectory distinguishes it from competitors. Industry analysis by TripleMinds concluded that Candy.ai achieved $25 million annual recurring revenue within months of launch—substantially faster than earlier competitors like Replika, which accumulated $25 million over eight months of 2024. This revenue velocity indicates substantially higher per-user monetization rates compared to competitors, reflecting Candy.ai's focused niche on premium adult-oriented companion experiences with aggressive pricing strategies.

The platform's rapid adoption across geographic markets (particularly strong in the United States, Europe, and select Asian markets) reflects successful product-market fit within the AI companion space. User surveys indicate that 62% of AI pornography/adult content users prefer customizable AI avatars over human performers—a preference pattern Candy.ai explicitly targets.

Industry projections estimate the broader AI companion sector could reach $150 billion annually by 2030 according to ARK Investment Management. Candy.ai's $25M+ current revenue positions it as a major beneficiary of this projected market expansion.

Core Technology and Features

Candy.ai operates on advanced Natural Language Processing employing large language models trained to produce contextually appropriate, emotionally resonant dialogue. The platform's conversational engine maintains character consistency across sessions, learns user preferences, and adapts interaction patterns based on accumulated conversation history.

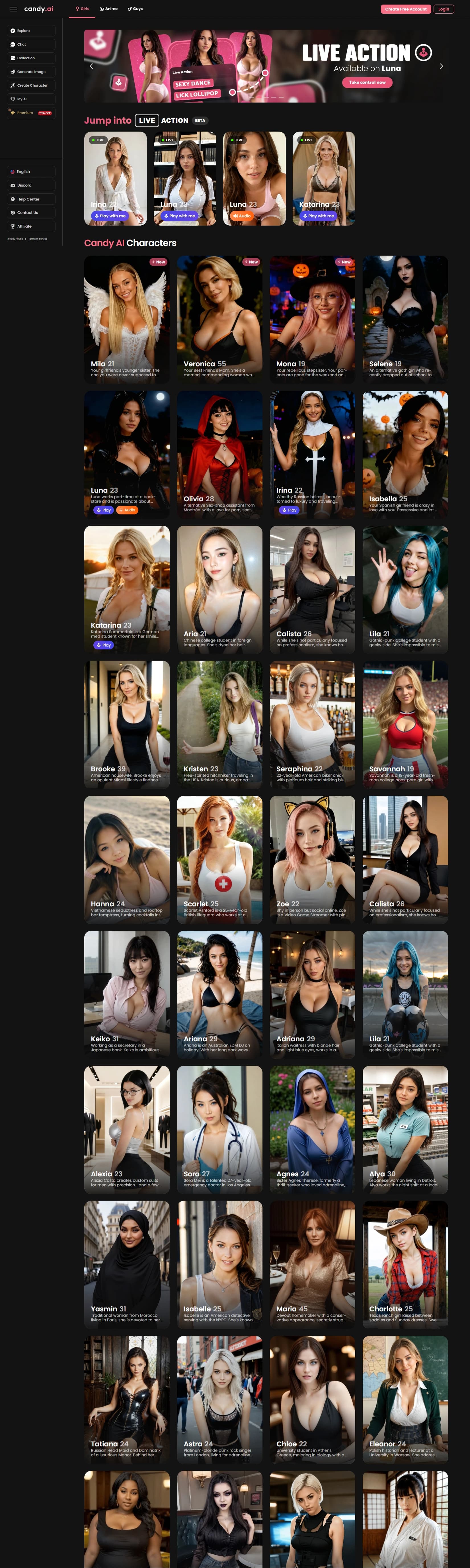

Character Library and Customization encompasses hundreds of pre-built characters across diverse archetypes alongside unlimited custom character creation. Users specify appearance (age, ethnicity, body type, facial features), personality traits (dominant/submissive, communication style, emotional expressiveness), sexual preferences, fetishes, backstory elements, and voice characteristics. This depth of customization exceeds most competitors' offerings.

Memory Systems represent a key technical differentiator. Candy.ai maintains extended context windows enabling the AI to reference previous conversations, remember stated preferences, recognize evolving personality dynamics, and maintain relationship continuity across sessions. This memory infrastructure creates genuine relationship simulation rather than isolated conversations.

Image and Video Generation create visual content depicting characters. Users request specific imagery during conversations, with the platform synthesizing photorealistic or stylized content matching specifications. Video generation reportedly produces smooth motion, realistic lighting, and character consistency throughout sequences.

Voice Integration enables voice calls to companions, providing audio communication alongside text interactions. Voice quality and emotional expressiveness reportedly rank among the best available, though some reviews note limitations in emotional depth during intimate scenarios.

The platform supports both Safe For Work (SFW) and Not Safe For Work (NSFW) interaction modes. NSFW access unlocks explicit content generation and unrestricted sexual roleplay scenarios.

Pricing: Transparent Base Tier with Hidden Token Costs

Candy.ai implements a transparent subscription model complemented by supplemental token packages:

Free Plan ($0 monthly) provides limited chat messages (10 daily), basic character browsing, one test image generation, and access to sample conversations. The free tier functions as evaluation mechanism rather than sustainable platform access.

Premium Subscription costs $12.99 monthly for month-to-month commitment, declining to $7.99 monthly ($23.97 quarterly) or $3.99 monthly ($47.88 annually). Premium includes unlimited text messages, unlimited character creation, 100 monthly tokens (valued at approximately $9.99), voice call access, image generation, and priority processing.

The advertised pricing transparency masks practical cost structures. Independent user reviews document that 100 monthly tokens depletes rapidly with regular NSFW interactions. Token consumption rates include:

Custom character creation: 10 tokens

Image generation: 4 tokens per image

Video generation: 12 tokens per video

Voice calls: 3 tokens per minute

NSFW content unlocks: 100-400 tokens per unlock

When complimentary tokens exhaust, users purchase supplemental packages: 100 tokens ($9.99), 350 tokens ($34.99), 550 tokens ($49.99), 1,150 tokens ($99.99), 2,400 tokens ($199.99), or 3,750 tokens ($299.99). Heavy users combining regular image generation, video requests, and voice calling regularly exceed $50+ monthly total costs despite modest base subscription rates.

Users report that tokens "disappear faster than you think," with one comprehensive review noting: "Within days, I found myself buying token packs that cost more than my subscription." This price discovery pattern represents deliberate platform monetization strategy maximizing revenue extraction from engaged users.

Billing discretion features prominently in platform marketing—transactions appear as "CANDY AI" or similar generic descriptors on bank statements rather than explicit adult service identifiers. Cryptocurrency payment options provide maximum transaction anonymity.

User Experience and Technical Performance

Candy.ai cultivates strong user satisfaction through several design choices. The conversational interface employs intuitive text-based chat matching consumer expectations from messaging apps. Character selection and management utilize card-based UI presenting character photos, personality summaries, and interaction quick-starts.

Mobile optimization delivers comparable functionality across smartphones, tablets, and desktop browsers. Users report smooth performance and minimal crashes, though occasional delays emerge during peak server load periods.

Conversation quality consistently receives praise from independent reviewers. One detailed analysis noted: "The conversation quality is remarkably natural; it often feels like I'm speaking with a real person." Users particularly value the platform's ability to maintain conversational context across lengthy interactions and adapt personality based on user preferences.

Image generation quality ranks among the industry leaders. Independent testing praised "exceptionally realistic" output rivaling dedicated image generation tools. Users can request specific appearances, clothing, poses, and scenarios, with the platform matching specifications accurately.

However, limitations persist. Token economics create friction—high-frequency users rapidly exhaust complimentary allocations. Customer support reportedly averages 24-hour response times without exemplary resolution efficiency. Conversation export capabilities lack—users cannot preserve chat histories for personal records. Repetitive phrases emerge after extended conversations with some characters.

Privacy and Data Security: Transparency Deficits

Candy.ai's privacy practices remain substantially opaque despite platform prominence. Independent security researchers criticize the platform's vague privacy policy lacking specificity regarding several critical concerns:

Conversation storage duration: The policy provides no explicit timeline for how long conversation records persist

Encryption protocols: The platform provides no details regarding whether conversations employ end-to-end encryption or server-side-only encryption

Third-party access: The policy doesn't explicitly state which entities access user conversations (developers, third-party data processors, law enforcement)

Data deletion requests: The platform doesn't clearly document procedures for users to request permanent data erasure

One independent security analysis concluded: "Candy AI does not provide the expected level of transparency and protection. Its privacy policy is short and vague."

Reddit users report anxiety about personal data security. One post documenting widespread user concern noted: "I've shared quite a bit of personal information with the AI, and now I find myself questioning its safety in terms of privacy. Are they keeping records of everything I say?"

The platform's Malta-based incorporation adds jurisdictional complexity. Malta operates under EU legal frameworks including GDPR, yet the specific data protection mechanisms Candy.ai implements remain undisclosed publicly.

Security incident history raises additional concerns. Sources document that "Candy AI has experienced several security incidents," though specific breach details remain limited in public reporting.

Regulatory and Legal Landscape

The regulatory environment surrounding Candy.ai has deteriorated significantly through 2024-2025. EU AI Act designates platforms generating explicit content as "high-risk" with mandatory transparency, documentation, and oversight requirements. GDPR applies strict data protection requirements for personal information processing, potentially exposing Candy.ai to substantial fines for privacy violations.

U.S. federal criminalization through the TAKE IT DOWN Act (May 2025) explicitly criminalizes non-consensual intimate imagery including AI-generated deepfakes. Forty-five states have criminalized AI-generated or computer-edited CSAM as of September 2025.

Litigation targeting AI pornography platforms has commenced. Doe v. Candy.AI represents early legal challenges testing platform liability for AI-generated content. Courts are debating whether AI outputs constitute "user-generated content" protected by Section 230, or whether platforms bear responsibility for generated content.

Copyright concerns emerge from studies documenting that AI models train on copyrighted material. Candy.ai's image generation algorithms potentially incorporate copyrighted artistic styles, creating intellectual property violation exposure.

Age Verification and CSAM Prevention Concerns

Candy.ai's age verification mechanisms lack transparent documentation. The platform presumably implements self-declaration age verification—users confirming they are 18+ through checkbox acknowledgments. This approach now violates UK Online Safety legislation effective July 2025 requiring more robust anonymous double-verification age assurance mechanisms.

The platform's character customization architecture enables age-specification through appearance parameters and explicit customization options. Enforcement separating adult character generation from minor depictions remains undocumented and suspect. Research documents multiple adult AI platforms failing to adequately restrict minor content generation despite policy prohibitions.

This represents serious concern given that NCMEC reported 485,000 AI-generated CSAM reports in early 2025—a 624% increase from the prior year. School incidents across multiple states documented male students using AI tools to create deepfake nudes of female classmates, including minors, from social media photographs.

Competitive Positioning: Market Leadership Through Aggressive Monetization

Candy.ai dominates the AI companion market through combination of factors. OurDream.ai emphasizes memory systems and customer relationship continuity but lacks Candy.ai's brand recognition and monetization scale. Replika focuses on emotional companionship but struggles with revenue generation comparable to Candy.ai. Character.AI offers extensive community-generated character libraries but provides inferior image generation and less adult-oriented positioning.

Candy.ai's competitive advantages include conversational sophistication, image/video generation integration, voice call features, and aggressive monetization strategy extracting higher per-user revenue than competitors. The platform's focused niche on adult-oriented companionship enables premium pricing exceeding more broadly-positioned competitors.

However, the token system has drawn criticism as extractive. One reviewer concluded: "Premium is worth it for the chats, but tokens feel like a cash grab." This sentiment reflects growing user awareness of token costs exceeding advertised subscription pricing.

Ethical Considerations: Attachment Formation and Psychological Impact

Candy.ai's design deliberately cultivates emotional attachment and relationship-like interactions. The memory systems, personality consistency, and voice integration create experiences feeling authentically personal and continuous. Research documents concerning psychological patterns among vulnerable populations using AI companions.

Users experiencing loneliness, social isolation, romantic rejection, or mental health challenges disproportionately engage with AI companions. The emotional engagement mechanisms Candy.ai employs intentionally maximize attachment formation among psychologically vulnerable cohorts.

Academic research identifies "gateway to offending" mechanisms where consumption of synthetic sexual content normalizes extreme material and erodes psychological barriers protecting against escalation to authentic illegal content. Studies document 62% of AI porn consumers prefer synthetic alternatives to human performers, reducing demand for human sex work but potentially normalizing increasingly extreme content.

Candy.ai's business model directly incentivizes maximizing engagement through compelling experiences encouraging continued interaction. This alignment of operator profit motive with attachment-optimization design raises ethical concerns about target user populations and psychological consequences.

Summary: Market Leadership Amid Regulatory Uncertainty

Candy.ai represents the technologically accomplished market leader in AI companionship, delivering sophisticated conversational AI, attractive customization, multimedia integration, and compelling user experiences. The platform's $25M+ revenue achievement within two years demonstrates successful product-market fit and user willingness to pay premium prices for engaging AI companions.

However, market success coexists with serious concerns. Privacy policies lack transparency regarding data encryption, retention, and third-party access. Age verification mechanisms employ self-declaration approaches now violating emerging regulatory requirements. The platform lacks documented CSAM prevention mechanisms despite rapid AI-generated CSAM proliferation. Token economics obscure true costs relative to advertised subscription pricing.

The regulatory environment has fundamentally shifted. Federal law criminalizes non-consensual deepfake pornography. Forty-five states criminalize AI-generated CSAM. EU regulations mandate high-risk platform oversight. These legal developments create direct user and operator liability regardless of platform disclaimers.

Bottom Line: Candy.ai delivers market-leading AI companion experiences with sophisticated technology, reasonable usability, and engaged user communities. For psychologically healthy adults seeking consensual romantic/sexual interactions with fictional characters without real-world likeness incorporation, the platform delivers technical competence. However, vague privacy policies, inadequate age verification, documented CSAM generation connections, and rapidly criminalizing legal landscape create substantial legal and ethical concerns. The platform's market leadership does not resolve fundamental questions about data protection, consent enforcement, and psychological vulnerability protection that increasingly define the regulatory environment for AI companionship platforms.

Related Reviews

HotChat.ai Review: Anime-Focused NSFW Chat Platform with Aggressive Monetization and Regulatory Concerns

HotChat Ai

GirlfriendGPT Review: Uncensored AI Companion Platform with Quality Limitations and Regulatory Challenges

GirlfriendGPT

Cuties.ai Review: Budget-Friendly AI Girlfriend Platform with Significant Quality and Legal Concerns

Cuties Ai